Mortgage Outlook

February 9, 2022 | Stephanie Buss

Mortgage Outlook for 2022

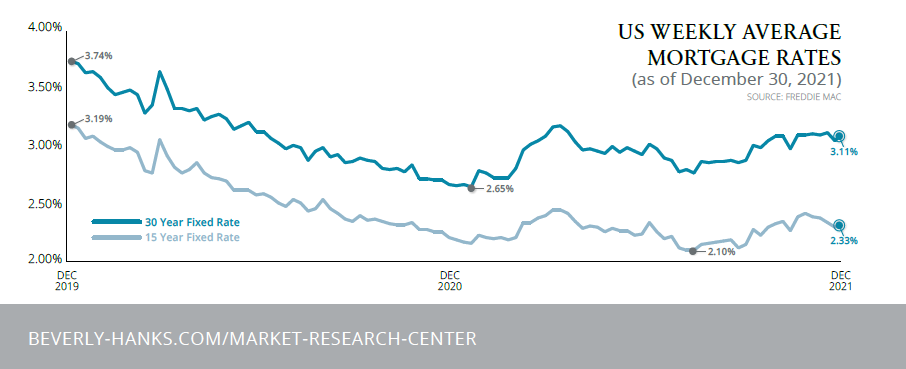

There seems to be little doubt among mortgage professionals that rates will rise in 2022. After bottoming out at 2.65% in the final days of 2020, rates have hovered close to 3%. Still, there is a difference of opinion regarding how much rates

will increase. Many economic variables can influence current borrowing rates, but, arguably, the Federal Reserve’s mandates and corresponding action can have the most profound impact.

The modern Federal Reserve has three mandates: reach full employment, keep inflation low, and maintain a stable financial system. During the pandemic, it brought short-term rates to zero while more than doubling the size of their balance sheet through the purchase of mortgage-backed securities and treasury bonds.

As of this report, the unemployment rate is declining towards 4%, and the inflation rate has blossomed to 7%. Six percent is the highest reading since the 1990s. With its first mandate in check, the Fed has turned its attention to managing inflation.

In November, the Fed began tapering its purchase of mortgage-backed securities and treasury bonds. Then at

their December meeting, they announced that they would double the speed of the taper starting in January. By March, the Fed will no longer be adding to their balance sheet and supporting the interest rates we’ve become accustomed to

over the past 18-24 months. During the December meeting, they also announced a plan for three rate hikes in 2022, assuming solid economic growth and inflation above 2%.

In response to the Fed’s announcement, the Mortgage Bankers Association predicts rates will hit 4% by the end of 2022 and

Fannie Mae is expecting a more comfortable 3.4% by year-end. On average, most economists and industry groups believe rates will hover around 3.3% for the first half of the year and climb towards 4% by December 2022. Ongoing employment concerns and the corresponding economic fallout caused by the latest wave of COVID infections will likely blunt the reactions to the Fed’s plan and allow for a slow organic increase in rates over the next 12 months.

Of course, you may be wondering if you have time to purchase a home or even complete a refinance before rates rise. If the past few years have taught us anything, it’s impossible to predict rates. But with the help of a professional loan officer, you can develop a plan based on current market conditions and your financial situation. It’s never too early to sit with a Beverly-Hanks Mortgage loan officer and devise a plan of your own.

Source: Beverly-Hanks Quarterly Market Report Q4 2021

Contact us for a personal copy, or visit the Beverly-Hanks Market Research Center.